Investment in Banking Sector of India

Banking and Financial sector is one of the fast3est growing sectors in India. Lots of foreign banks and financial institution have shown interest in Investing in this sector in India. It is estimated that the sector provides investment opportunity of $25billion in the next five years.

Facts and Figure

- In the year 2004, the total banking assets was $450 billion in 2004. Since 1991 this has shown the robust growth of 15% p.a.

- Market capitalization of the Indian bank is over $450 billion. Turnover of the banks have grown to $1,170 billion in 2003-04 from $285 billion in 2002-03

- Since 1993, the Mutual Funds assets have shown the strong growth of 13% p.a . Total mutual fund asset in 2004 was $45 billion.

- More than 40 Venture Capital and Private Equity Funds operate in India

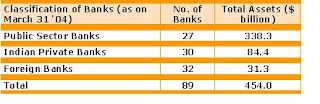

Structure

Large part (75%) of the market is held by the public sector banks. However private Indian banks and the foreign banks are growing very fast .The three topmost foreign banks operating in India are Standard Chartered Bank, Citibank and HSBC which accounts for more than 65% of the total assets of foreign banks. There are many global players of banking & financial services are operating in India. Some of them are - Morgan Stanley, Merrill Lynch, JP Morgan, Deutsche Bank, UBS, ABN Amro, Barclays, Calyon etc. Apart from banking sector there are also many companies that are doing very well in mutual fund sector. Some of these companies are as - UTI Mutual Fund, Prudential ICICI, HDFC, Franklin Templeton, Birla and Tata

Government Policy

- RBI, Reserve Bank of India is the sole regulator for the Banking and Financial Services industry.

- RBI has issued guidelines to adopt Basel II by December 2006. All the foreign investment in this sector requires prior approval of RBI.

- Foreign banks are allowed to operate in India either by setting up branches or through a wholly owned subsidiary, after approval by RBI.

- Foreign share in the Indian banks can be upto 74% with a 5% cap on ownership by any one entity

Business Potential and Opportunities

- Banking and the financial sector contain huge potential of investments and returns on those investments. By 2010, it is expected that banking sector would grow $915 billion with an average growth rate of 15%.

- According to estimates nearly $70 billion additional equity is needed for growth plus Basel II compliance. Moreover the market of mutual fund is also expected to grow by 15% till 2010. The growth in retail finance is also expected to grow at an annual rate of 18%, from $27.6 billion in 2003-04 to $64.2 billion by 2008-09.

- The retail off take is high because majority (54%) of the population is in the 15-35 years age group. The economic growth of 12% and the increasing capital expenditure by the Government and private industry too would give a boost to this sector.

- Small scale enterprise account for 40% of the industrial output and 35% of direct exports. SME lending which is still an untapped market presents a lucrative opportunity to the foreign and the domestic investors. Moreover the improved asset management practices - Gross NPAs to Advances ratio reduced from 24-25% in 1993 to 7-8% in 2004, too indicates the health of the banking sector and hence the investment and the growth opportunity.

Unknown

August 5, 2010 at 3:25 AM

this is not a usefull information