the Reserve Bank of India (RBI) to set up a bank in the private sector, as part of the RBI's liberalisation of the Indian Banking Sector. The bank was incorporated in August 1994 in the name of 'HDFC Bank Limited', with its registered office in Mumbai, India. HDFC Bank commenced operations as a Scheduled Commercial Bank in January 1995.

the Reserve Bank of India (RBI) to set up a bank in the private sector, as part of the RBI's liberalisation of the Indian Banking Sector. The bank was incorporated in August 1994 in the name of 'HDFC Bank Limited', with its registered office in Mumbai, India. HDFC Bank commenced operations as a Scheduled Commercial Bank in January 1995.The authorised capital of HDFC Bank is Rs.450 crore (Rs.4.5 billion). The paid-up capital is Rs.311.9 crore (Rs.3.1 billion). The HDFC Group holds 22.1% of the bank's equity and about 19.4% of the equity is held by the ADS Depository (in respect of the bank's American Depository Shares (ADS) Issue). Roughly 31.3% of the equity is held by Foreign Institutional Investors (FIIs) and the bank has about 190,000 shareholders. The shares are listed on the The Stock Exchange, Mumbai and the National Stock Exchange. The bank's American Depository Shares are listed on the New York Stock Exchange (NYSE) under the symbol "HDB".

The headquarter of the bank is in Mumbai. The Bank at present has a robust network of over 746 branches spread over 329 cities across India. All branches are linked on an online real-time basis. Customers in over 120 locations are also serviced through Telephone Banking. The Bank's expansion plans take into account the need to have a presence in all major industrial and commercial centers where its corporate customers are located as well as the need to build a strong retail customer base for both deposits and loan products. Being a clearing/settlement bank to various leading stock exchanges, the Bank has branches in the centers where the NSE/BSE has a strong and active member base.

The Bank also has a network of about over 1647 networked ATMs across these cities. Moreover, HDFC Bank's ATM network can be accessed by all domestic and international Visa/MasterCard, Visa Electron/Maestro, Plus/Cirrus and American Express Credit/Charge cardholders.

- Savings Account

- HDFC Bank Preferred

- Sweep-In Account

- Super Saver Account

- HDFC Bank Plus

- Demat Account

- HDFC Mutual Fund

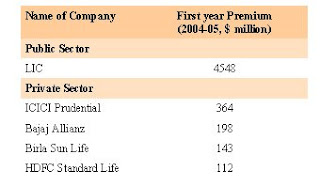

- HDFC Standard Life Insurance

- HDFC Phone Banking

- HDFC ATM

- HDFC Inter-city/Inter-branch Banking

- HDFC Net Banking

- HDFC International Debit Card

- HDFC Mobile Banking

- HDFC Bill Pay

Personal Loan

- HDFC New Car Loan and Used Car Loan

- HDFC Loan Against Shares

- HDFC Two Wheeler & Consumer Loan

- HDFC Home Loan

Head Office

Ramon House, 169, Backbay Reclamation