Pre-requisite of Taxes in India

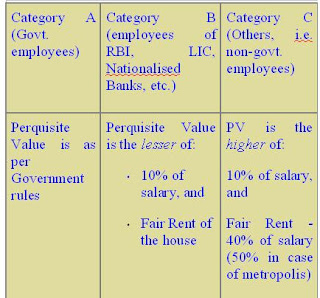

The Act includes perquisites in the inclusive definition of salary by virtue of Sec 17(1). Thus perquisites are taxable as income under the head ‘Salary’. Sec 17(2) lists certain items which are to be treated as perquisites, for example, accommodation free of rent or at concessional rental charges, stock options, life insurance premium, etc.

Sec 17(2) also specifies certain medical benefits which are not to be included as perquisites.The rules for valuation of the following perquisites are given in Rule 3 of the Income Tax Rules:

These items are non-monetary and hence the need for laying down valuation rules.

What is Fair Rent?

Fair Rent is the municipal valuation of the accommodation, or rent which a similar accommodation would realize in the same locality, whichever is higher. However, it cannot exceed the standard rent, if any, fixed or determine under a Rent Control Act. If the employer hires the accommodation, Fair Rent Value is the actual rent paid for the accommodation

What is Municipal Valuation of Fair Rent?

House tax is collected by municipality on the basis of its rental value, ie the municipality decides what will be the rental value if the house is given on rent. Such rental value is called Municipal Valuation of Fair Rent.

What is Standard Rent?

Under the Rent Control Act, Standard Rent is the highest possible rent of a particular property,

Thus, where Rent Control Act is applicable, Standard Rent shall act as an upper ceiling on the figure of Fair Rent.

How is Salary determined for the purpose of Valuation of Rent Free Accommodation?

For the purpose of Valuation of Rent Free Accommodation, salary is determined on the following basis:

1) Salary is taken on due basis only.

2) The following are the components of salary : Basic Pay, Dearness Allowance/ Dearness Pay (if it forms part of salary for the purpose of retirement benefits, ie gratuity, pension, PF and leave salary), bonus, commission, fees, etc., taxable portion of all allowances, reimbursement of income tax and professional tax, reimbursement of gas, electricity and water expenses, any other payment.

3) The following items are excluded from the computation of salary: value of all perquisites, employer’s contribution to PF and interest thereon.

What if the employer takes a house on rent for the employee?

While computing the value of fair rent, whether defacto rent (the rent paid by the employer) is to be considered or not, is controversial.

a) One view is that defacto rent should be ignored as the Income Tax Rule on valuation of rent free accomodation is silent about it.

b) The second view equates defacto rent to fair rent.

c) The third view takes defacto rent into consideration for calculating fair rent. As per this view, if defacto rent exceeds the fair rent calculated otherwise (i.e, upto the step in which Standard Rent is considered), then defacto rent shall be taken to be the Fair Rent.

What if the Rent Free Accommodation is a furnished one?

In this case, first the value of rent free accomodation is calculated assuming it is not furnished. If the furnishing is owned by the employer, 10% of the original cost of furnishing is added; and if the furnishing is taken on hire, the actual hire charges are added.

What are the valuation rules for Accommodation provided at concessional rates?

First, the perquisite value is calculated assuming the accomodation is provided rent free. From this value, the rent for the period of occupation payable by the employee to the employer is deducted. This gives the perquisite value for accomodation provided at concessional rates.

What are the valuation rules for Rent Free Accomodation?

Is the Motor Car facility treated as a perquisite for all types of employees?

No, a motor car provided to employees shall be treated as a perquisite only in the case of ‘specified employees’. However, if the car is owned by the employee and the employer merely bears the expenses on the car, then the perquisite value shall be computed even if the employee is not a specified employee.

Who is a ‘specified employee’?

A ‘Specified employee’ is the one who satisfies any of the following cases:

- he is a director of the company,

- he has a substantial interest in the company, ie he is the beneficial owner of equity shares carrying 20% of voting power in the employer company.

- his monetary income under the head "Salaries" for the year exceeds Rs.24,000. The amount considered here includes amounts due from, paid or allowed by one or more employers. It excludes all non-monetary benefits.

- Also, deductions in respect of monetary payments exempt from income tax, standard deduction, deduction for educational allowance and deduction on account of professional tax will be allowed for this purpose.

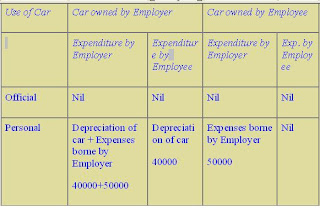

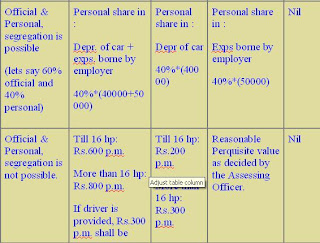

How is the value of Motor Car facility computed? The following table gives the perquisite value of the motor car facility under different situations, taking the written down value of the car at the beginning of the year as Rs.2,00,000, depreciation u/s 32 of the Income Tax Act at 20%, ie Rs.40000 and expenses on the car during the year Rs.50,000.

What happens in case the employer maintains a pool of cars?

If the employer has provided a number of cars of different horse powers to a number of employees, for personal as well as official uses, it will be presumed that every employee was using the car with the highest horsepower rating and the perquisite value will be computed accordingly.

Similarly, if there are some cars without driver and some with driver, it will be presumed that every employee was using the car with driver.

What if the employee pays certain amount for using the car?

If the employee is paying a certain amount for using the car, such payment shall be deducted from the perquisite value.

What if the employee uses the official car only to commute between office and residence?

Such use shall be treated as official use and hence there is no perquisite.

Is the gas / electricity / water facility a perquisite for all employees?

If the facility for gas/ electricity/ water is provided by the employer, then the perquisite value shall be computed only in the hands of specified employees.

If the connection is in the name of the employee and the employer merely bears the expenses, perquisite value shall be computed even if the employee is not a specified employee.

How is the perquisite value computed for gas/ electricity/ water facility provided by the employer?

- If the facility is provided by the employer, it shall be a perquisite only in the hands of specified employees.

- If the employer supplies these from his own sources, PV = Nil

- If the facility is purchased by the employer and the employee uses it only for personal purposes, PV = the amount spent by the employer.

- If the facility is purchased by the employer and is used by the employee for both official and personal purposes, then PV is taken as 6.25% of salary but shall not exceed the amount actually spent by the employer.

Salary for this purpose shall be:

- Basic pay on due basis

- Dearness Allowance or dearness pay, if the terms of employment so provide Commission, if it is on sales turnover, calculated at a fixed rate and the employee works in the sales department.

What if the gas/ electricity/ water connection is in the name of the employee and the employer bears the expenses?

This is a case of reimbursement of employee’s expenses. All employees shall be covered, whether or not they are specified employees. The entire amount borne by the employer shall be taken to be the perquisite value.

What are the rules for computing perquisite value of Free Education provided by the employer?

- Free Education provided by the employer is a perquisite only for specified employees.

- If the employer provides free education to employee, PV = Nil.

- If the employer provides free education to the family members of the employee, PV = actual amount spent by the employer.

- If free education is provided in an institution run by the employer himself, PV = cost of education in a similar institution in the same locality

- If any scholarship is given to the family members of the employee purely on the basis of merit, PV = nil.

What if the employee’s costs on education are borne by the employer?

The entire amount borne by the employer shall be the perquisite value. This shall be applicable in the cases of all employees, not just the specified employees.

What are the valuation rules for transport facility provided by a transport undertaking free of cost or at concessional rates?

Nil. Various organizations running transport services provide free or concessional travel to their employees/ their family members/ dependent relatives in conveyance owned by the undertaking. The perquisite value of such benefit shall be taken to be nil.

How to value a perquisite for which no specific rules are given in Rule 3 of the Income Tax Rules?

The valuation will be done in a way the Assessing Officer considers fair and reasonable.

How is the perquisite value determined in case a watchman / sweeper / gardener / other domestic servant is hired by the employee and the expense is borne by the employer?

The actual expense borne by the employer shall be taken to be the perquisite value. This shall apply to all categories of employees, not just the specified employees.

What if the servant is hired by the employer and his services provided to the employee?

In this case, perquisite shall be only in the hands of specified employees. The Perquisite Value in the case of watchman, sweeper and gardener shall be Rs.120 per month per person. For other domestic servant, the PV shall be actual wages paid by the employer.